AAR Reports Third Quarter Results

WOOD DALE, Ill., /PRNewswire/ -- AAR (NYSE: AIR) today reported net income of $5.4 million and diluted earnings per share of $0.20 for the third quarter of fiscal 2001, which ended February 28, 2001. Sales for the quarter, excluding pass through sales, were $200.1 million. This represented the third quarter of sequential net income and earnings per share improvement.

The sequential earnings improvement was principally driven by continued strength in the Company's component repair and overhaul businesses, higher margins, lower selling, general and administrative expenses and lower interest expense on lower average borrowings. Sales for the third quarter of fiscal 2001 were down slightly from the second quarter largely due to seasonality.

Sales and net income were down from prior year levels of $256.6 million and $11.0 million, respectively, due to continuing difficult industry conditions.

"During the third quarter, sales to the newer generation aircraft and engine markets, including sales to the relatively fast growing regional aircraft market, grew and represented a greater proportion of our total sales. We continue to invest in assets supporting new generation aircraft including engines, auxiliary power units, avionics and landing gear," said AAR President and CEO, David P. Storch.

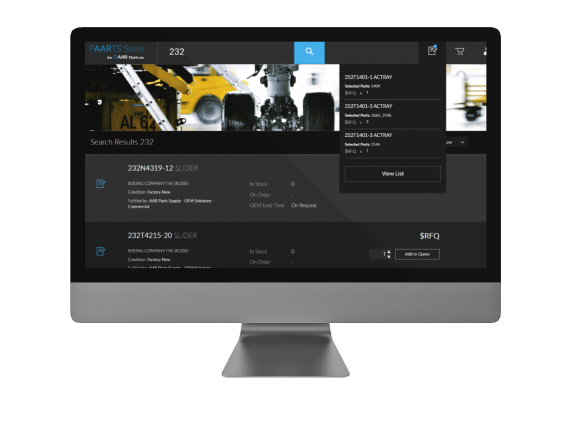

"Additionally, we have recently received several contracts for comprehensive support programs. AAR is one of the few companies to offer customized inventory and logistics programs in support of the world's aircraft fleet," Storch continued. "The industry is heightening its focus on improving efficiencies within the supply chain. With AAR's combination of parts supply, logistics, repair and overhaul capabilities and financial strength, we are in an ideal position to take advantage of this trend."

Significant developments in the third quarter included the following:

-

AAR was awarded a two-year contract with MTU Maintenance Canada, an independent aircraft engine services provider, to provide a customized inventory supply and management program.

-

AAR was awarded contracts with Dyncorp and Lear Siegler for global repair and overhaul support of over 400 propellers installed on U.S. Army C-12 and U.S. Navy C-26 aircraft.

-

AAR was awarded a contract by United Parcel Service to design and manufacture the main deck cargo loading systems for their MD-11 freighters.

-

AAR was awarded a one-year engine parts support agreement by Air France.

-

AAR was awarded two contracts to train Egyptian Air Force personnel for maintenance of certain aircraft components.

-

AAR signed a three-year consignment agreement with Southwest Airlines under which AAR will be responsible for managing, marketing and selling certain spare airframe rotables and surplus avionics inventory.

AAR Corp. (NYSE: AIR) is the preeminent provider of products and value-added services to the worldwide aerospace/aviation industry. Products and services include proprietary inventory management and logistic support services, encompassing supply, repair and manufacture of spare parts and systems. Headquartered in Wood Dale, Illinois, AAR serves commercial and government aircraft fleet operators and independent service customers throughout the world. Further information can be found at www.aarcorp.com.

AAR will hold its quarterly conference call at 10:00 AM (CST) on Tuesday, March 20, 2001. The conference call can be accessed via dial-in (1-719-457-2604; conference code 521655). A replay of the call will be available (1-719-457-0820; conference code 521655) until 12 AM on Tuesday, March 27, 2001.

This press release contains certain statements relating to future results, which are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on beliefs of Company management as well as assumptions and estimates based on information currently available to the Company, and are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated, depending on a variety of factors, including: implementation of information technology systems, integration of acquisitions, marketplace competition, economic and aviation/aerospace market stability and Company profitability. Should one or more of these risks or uncertainties materialize adversely, or should underlying assumptions or estimates prove incorrect, actual results may vary materially from those described.

AAR CORP. and Subsidiaries

Comparative Statement

of Earnings Three Months Ended Nine Months Ended

(In thousands except per share data) Feb 28/29, Feb 28/29,

2001 2000 2001 2000

(Unaudited) (Unaudited)

Sales $ 200,055 $ 256,558 $ 632,580 $ 750,537

Pass through sales 16 15,773 20,596 48,717

Total sales 200,071 272,331 653,176 799,254

Gross profit 35,746 45,074 105,498 134,992

SG&A 23,287 24,404 71,710 72,556

Operating income 12,459 20,670 33,788 62,436

Interest expense 5,433 5,979 17,139 17,749

Interest income 450 959 1,201 1,929

Pretax income 7,476 15,650 17,850 46,616

Net income 5,388 10,955 12,825 32,692

Earnings Per Share-Basic $ 0.20 $0.41 $ 0.48 $1.20

Earnings Per Share-Diluted $ 0.20 $0.40 $ 0.48 $1.19

Average shares outstanding-Basic 26,941 26,942 26,904 27,178

Average shares outstanding-Diluted 27,064 27,273 26,999 27,520

Balance Sheet Highlights February 28, May 31,

(In thousands except per share data) 2001 2000

(Unaudited) (Derived from

audited financial

statements)

Current assets $ 526,537 $ 511,267

Current liabilities 167,852 163,816

Working capital 358,685 347,451

Total assets 754,718 740,998

Long-term debt 180,106 180,447

Stockholders' equity 344,865 339,515

Book value per share $ 12.80 $ 12.64

Shares outstanding 26,945 26,865

Sales By Business Activity Three Months Ended Nine Months Ended

(In thousands) February 28/29, February 28/29,

2001 2000 2001 2000

Aircraft and Engines $ 71,651 $ 125,379 $ 246,336 $ 366,450

Airframe and Accessories 101,102 101,908 312,481 294,661

Manufacturing 27,302 29,271 73,763 89,426

$200,055 $256,558 $632,580 $750,537

Pass Through Sales 16 15,773 20,596 48,717

$200,071 $272,331 $653,176 $799,254

SOURCE AAR CORP.

CONTACT: Timothy J. Romenesko, Vice President, Chief Financial Officer of AAR Corp., 630-227-2090, or tromenesko@aarcorp.com

Related news

See all

July 01, 2025

AAR to announce fourth quarter fiscal year 2025 results on July 16, 2025

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, today announced that it will release financial results for its fourth quarter of fiscal year 2025, ended May 31, 2025, after the close of the New York Stock Exchange trading session on Wednesday, July 16, 2025.

June 05, 2025

AAR subsidiary Trax selected to modernize Delta TechOps’ maintenance and engineering systems

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced today its aviation maintenance software subsidiary, Trax, has been selected to modernize Delta TechOps’ maintenance and engineering systems.

May 06, 2025

AAR announces investor conference schedule for May and June 2025

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced today that the Company’s senior management will participate in the upcoming conferences listed below.