AAR Believes Recent Stock Activity Unrelated To Fundamental Performance, Outlook

"AAR's fundamental performance and outlook remain solid," Storch said. "Management believes that last week's activity in our stock is related to Boeing Aircraft's recently announced difficulties. Management would like to reiterate that as a customer, Boeing accounts for less than one percent of AAR's business. In addition, as previously noted, AAR derives less than three percent of revenues from the depressed Asian market which Boeing cited as a cause of some of its problems." Storch went on to say, "Typically, a reduction in the delivery of new aircraft creates greater demand for support services for the existing world fleet."

Contact

Media Team

Corporate Marketing & Communications

+1-630-227-5100

Editor@aarcorp.com

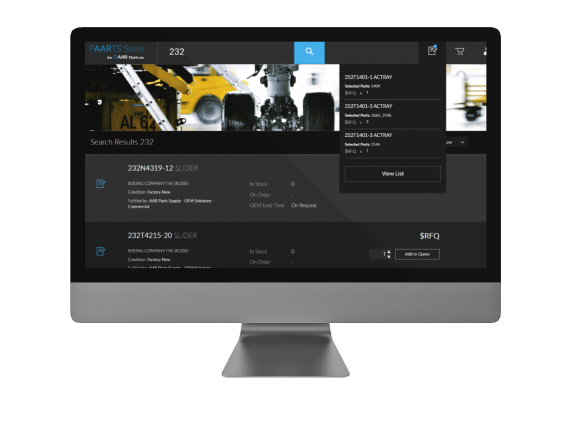

AAR CORP., traded NYSE (AIR), and headquartered in Wood Dale, Illinois, is a leading supplier of aerospace/aviation products and services. The Company primarily supplies parts and equipment, performs technical services and manufactures proprietary products for the global aviation industry.

Related news

See all

March 10, 2026

AAR to announce third quarter fiscal year 2026 results on March 24, 2026

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, today announced that it will release financial results for its third quarter of fiscal year 2026, ended February 28, 2026, after the close of the New York Stock Exchange trading session on Tuesday, March 24, 2026.

February 26, 2026

AAR signs new agreement with Otto Instrument Service

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, has signed a new agreement with Otto Instrument Service to sell and support the LASEREF IV inertial reference system product line. The agreement reinforces AAR’s strategy to broaden its OEM distribution portfolio serving the business aviation market.

February 11, 2026

AAR appoints Dylan Wolin as Chief Financial Officer

Wood Dale, Illinois — AAR CORP. (NYSE: AIR), a leading provider of aviation services to commercial and government operators, MROs, and OEMs, announced today that its Board of Directors has appointed Dylan Wolin as the Company’s Chief Financial Officer, effective February 23, 2026. Wolin’s responsibilities will include finance, accounting, tax, treasury, investor relations, and corporate development.